(IKNA) Ikena Oncology: Strategic Alternatives & RIF Announced

Thu May 30 2024/1 minute read

I recently returned from a short break and until yesterday, I hadn't come across many interesting ideas. Similar to the recent theme of busted biotechs, Ikena Oncology ($76M market-cap) announced yesterday that it has begun exploring a range of strategic alternatives for the business. Ikena, focused on developing oncology treatments, disclosed that it is discontinuing the clinical IK-930 program while continuing the development of IK-595. Additionally, the company announced a workforce reduction of 53%, leaving approximately 20 employees remaining.

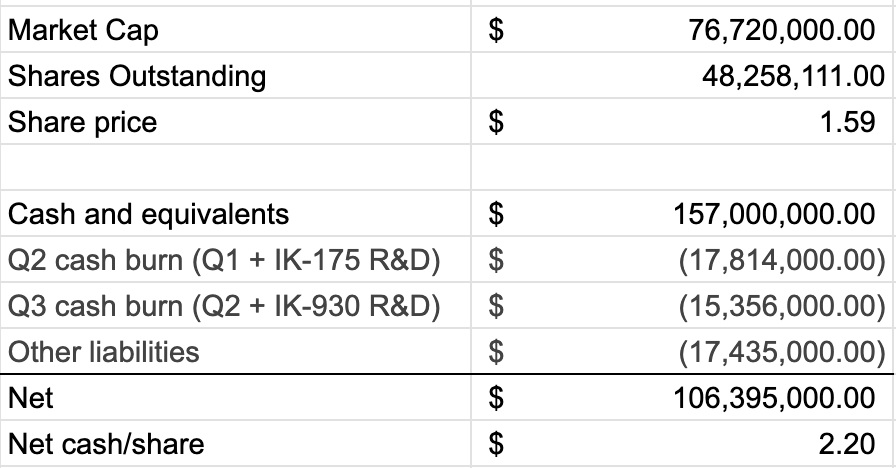

While the ongoing development of IK-595 is the hair in the soup here, I like that IKNA has sizable insider and active institutional ownership. Orbimed Advisors LLC owns 8.45% of the business. I’ve had good experience working with them in the past (see $THRX). Furthermore the founder, Mark Manfredi also owns 3.63% of the business. A quick liquidation could certainly benefit him immensely, far exceeding his 2023 TC of $1.2M. Here’s my rough swag estimate:

I don’t see any major red flags here. The non-cancellable lease obligation is cheap and the SF office has been sub-leased already. Given that the SEC Release 33-11265 affecting reverse mergers goes into effect July 1st, I’d expect a fairly shareholder friendly outcome here.

Disclosure: I own shares of IKNA