Galera Therapeutics ($4.2M market-cap) is a biotech company focused on building radiotherapy solutions for cancer treatment. Unfortunately, their clinical trials delivered underwhelming results and they now find themselves with an empty pipeline, ready to liquidate their remaining assets.

Earlier this year, Galera was involved in a litigation case with Alira Health for alleged breach of contract and negligence related to an error by the CROs in 2021 in the statistical program for the Phase 3 ROMAN trial of Avasopasem for the reduction of severe oral mucositis. As part of the settlement, Galera received a cash payment of $975K and announced liquidation a week later. Part of me expected the liquidation as the company got delisted to OTC markets and did not even raise an objection, eliminating any possibility of a reverse merger.

What’s really interesting is that earlier this year, an individual investor named Yair Schneid bought almost 30% of the company. It is possible that Yair knew about the outcome of the litigation and the events that followed.

It is also noteworthy that previously Galera entered a deal with Blackstone Life Sciences, where Blackstone agreed to pay Galera up to $117.5 million in milestones for clinical trial progress. In return, Galera owed Blackstone a share of sales from specific products. Galera treated this as debt on their books, with interest calculated based on expected future sales and timing of the FDA approvals. However, due to discontinued trials and financial constraints, Galera stopped recognizing interest on this debt after October 2023. If no products are sold, Galera doesn't owe Blackstone. However, in case of the liquidation the Royalty Agreement remains effective, and any future purchaser or licensor of the products would be bound by the agreement's terms. This means Blackstone’s right to receive product payments would continue with the new owner.

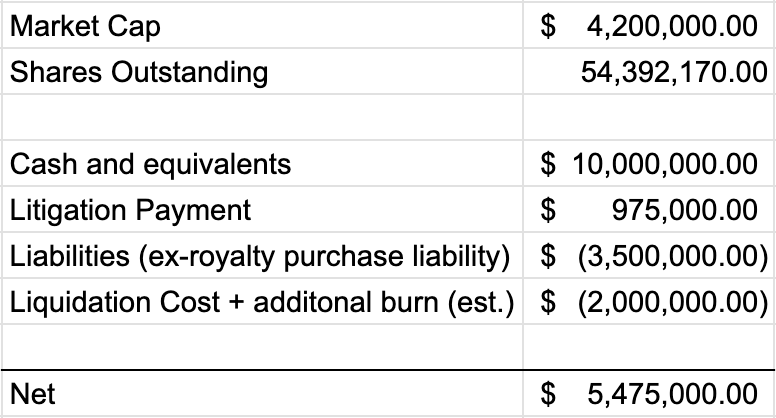

Putting everything together, this is my rough swag estimate:

Apparently the board meeting will be held on October 17th, I received a call yesterday from someone who reached out to me on LinkedIn to vote on the liquidation. I voted in-favor.

Disclosure: I own shares of GRTX